The Cost Of Waiting To Get Life Insurance!

Lock In Your Lowest Life Insurance Rate

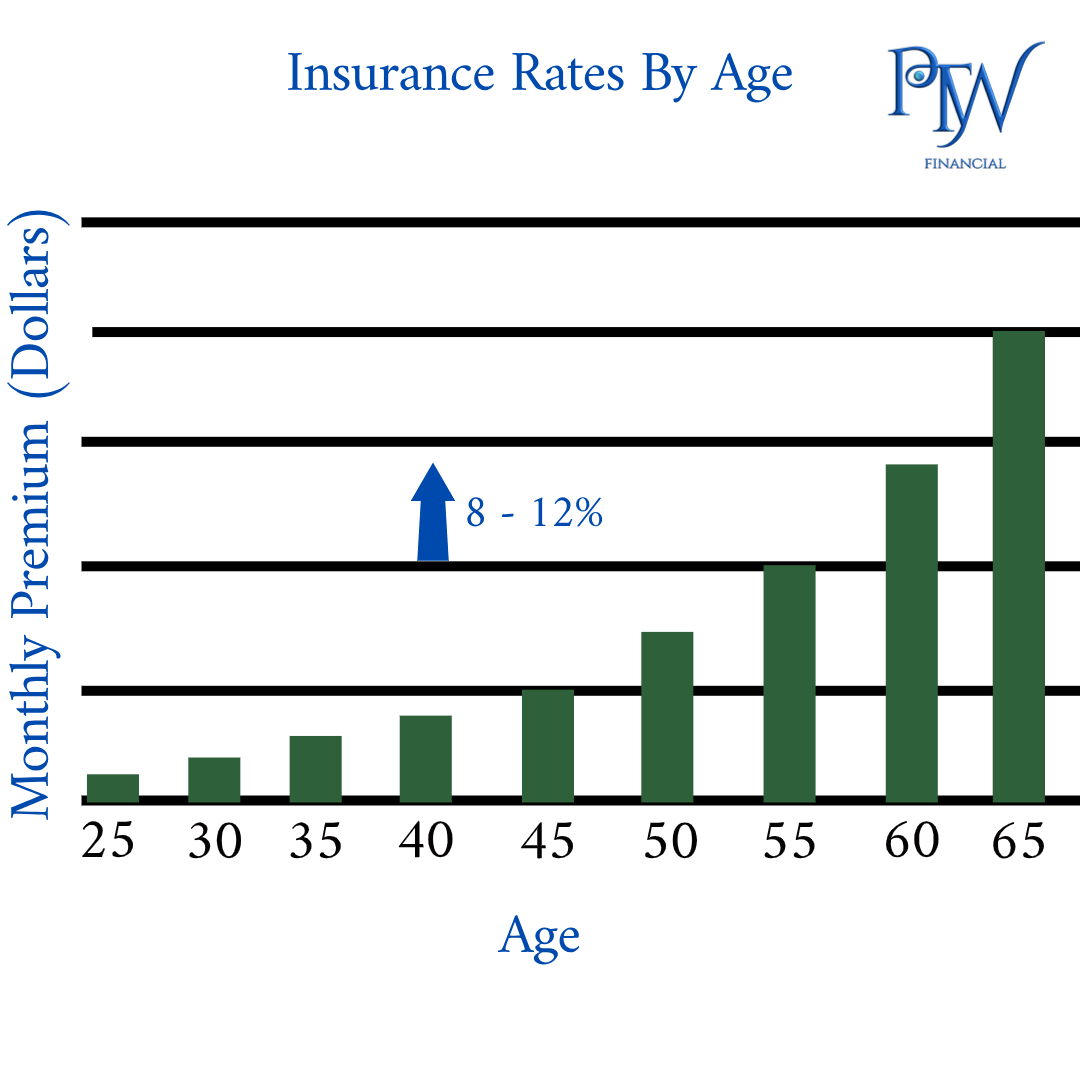

The older you get, the more life insurance rates increase. The sooner you buy, the sooner you lock in your lowest premium-and save the most money in the long run.

Waiting Could Cost You!

Purchasing life insurance early typically sets you up for the best rates. The cost of purchasing insurance can increase by 8% to 12%, on average, for each year you delay. However, when you sign your policy, your rate is locked in and will not change during the policy’s term.

For example, a 40-year nonsmoking male in good health could get a new 20-year term policy with $1 million in coverage for $2,172 a year*. However, if he were to purchase the same policy at age 41, his cost would rise to $2,340 a year, and he’d spend $2,508 annually if he waited another year.

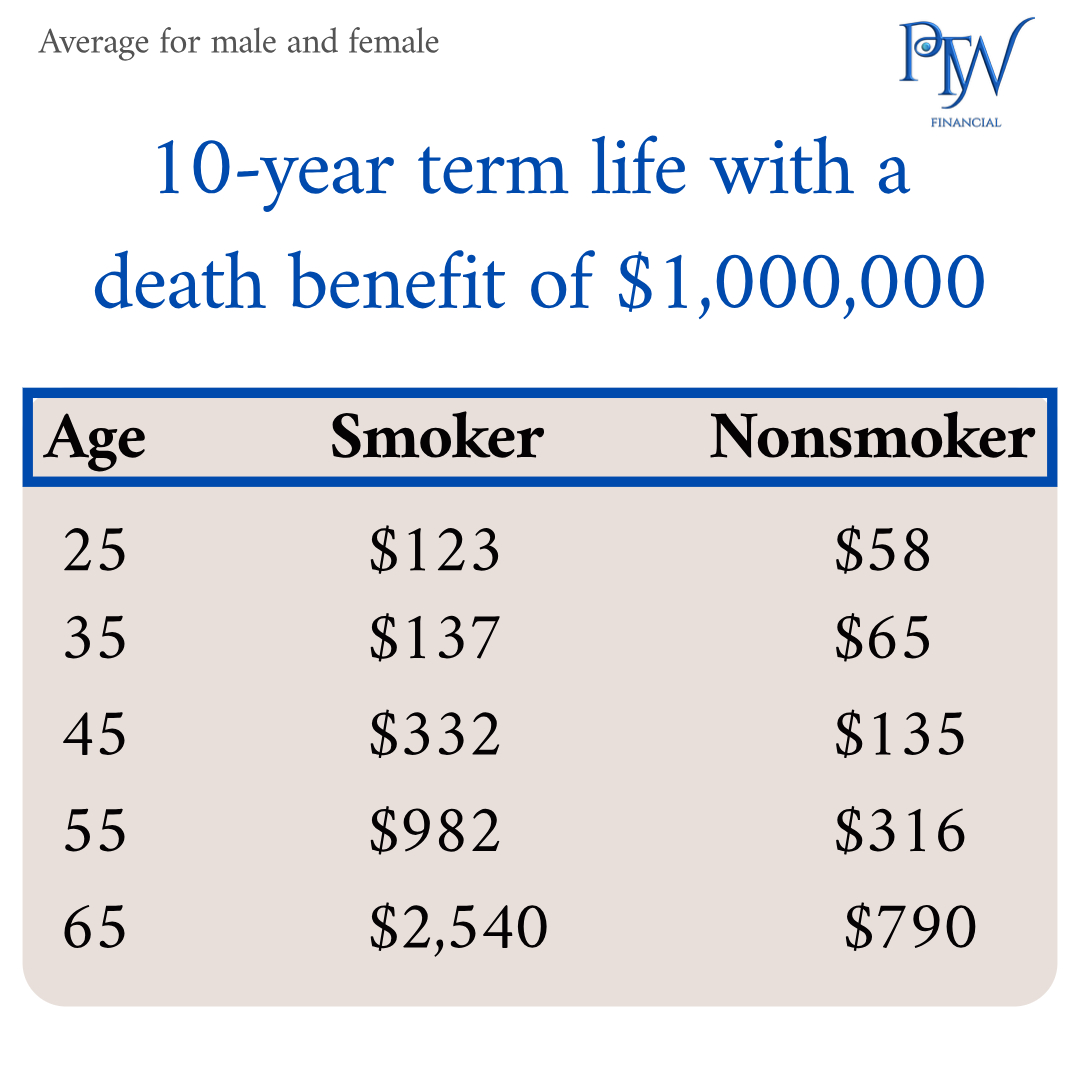

Average Term Life Insurance Rates By Age

As you age, your average life insurance costs increase. Based on our policies, we developed a chart that shows the shift in premiums based on different groups. The term life quotes shown represent a 10-year term life insurance policy with a death benefit of $1 million for applicants in good health.

In this scenario, the monthly cost of insurance for a 35-year-old nonsmoker would be $65. A 45-year-old nonsmoker would pay $135 monthly premium for the same policy*. By purchasing this policy at the age of $35 instead of $45, you could save $840 per year over the life of your policy.

*Quotes as of 2020. Please note that the figures used are for demonstration purposes only and may not reflect individual quotes. “How Age Affects Life Insurance”, Investopedia. https://www.investopedia.com/articles/personal-finance/022615/how-age-affects-life-insurance-rates.asp

Original graphic by Ethos.

- Get A Free Instant Quote!

- Get A Free Instant Quote!

Contact us today to secure your family’s financial future!

- Get A Free Customized Quote!

- Get A Free Customized Quote!

Do I Need Life Insurance? 🤔

If something happens to you, your loved ones do not just lose you—they also lose your income, on top of everything else you provide. If you provide financial or caregiving support to someone, it is...

What Are Living Benefits In Life Insurance?

Life insurance is not only about the death benefits your beneficiary receives after you pass away. These policies can also give you benefits while you are still alive. These are called living...

0 Comments